Answer the following questions using the information below:

Dustin Plastics, Inc., manufactures plastic moldings for car seats. Its costing system utilizes two cost categories, direct materials and conversion costs. Each product must pass through Department A and Department B. Direct materials are added at the beginning of production. Conversion costs are allocated evenly throughout production.

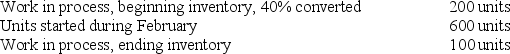

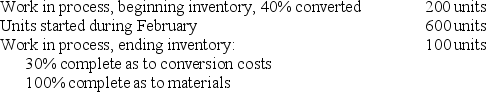

Data for Department A for February 2012 are:

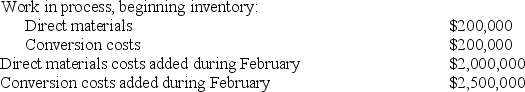

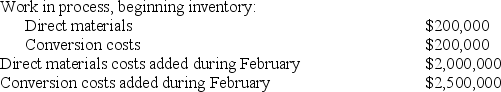

Costs for Department A for February 2012 are:

Costs for Department A for February 2012 are:

-Dustin Plastics, Inc., manufactures plastic moldings for car seats. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through Department A and Department B. Direct materials are added at the beginning of production. Conversion costs are allocated evenly throughout production. Data for Department A for February 2012 are: Costs for the Department A for February 2012 are:

Costs for the Department A for February 2012 are: What were the equivalent units of direct materials and conversion costs, respectively, at the end of February? Assume Dustin Plastics, Inc., uses the weighted-average process costing method.

What were the equivalent units of direct materials and conversion costs, respectively, at the end of February? Assume Dustin Plastics, Inc., uses the weighted-average process costing method.

Definitions:

Raw Materials

The basic materials from which products are manufactured or made.

Control Accounts

Accounts used in the general ledger to summarize the detail contained in a subsidiary ledger, helping to simplify and organize financial information.

Factory Labor

The workforce engaged in operating machinery and performing tasks involved in the manufacturing process.

Factory Wages Payable

Liabilities accounts that represent amounts owed to factory workers for wages earned but not yet paid.

Q35: What is the direct material cost assigned

Q44: The sales-mix variance will be favorable when:<br>A)the

Q53: What were the equivalent units for materials

Q55: Shortening delivery times is a minor part

Q63: Oregon Lumber processes timber into four products.

Q63: How much will external failure costs change

Q76: The sales-quantity variance results from a difference

Q83: The practical capacity method of allocating costs

Q89: How much do external failure costs change

Q103: In calculating cost per equivalent unit, the