Answer the following questions using the information below:

The Rest-a-Lot chair company manufacturers a standard recliner. During February, the firm's Assembly Department started production of 75,000 chairs. During the month, the firm completed 80,000 chairs, and transferred them to the Finishing Department. The firm ended the month with 10,000 chairs in ending inventory. There were 15,000 chairs in beginning inventory. All direct materials costs are added at the beginning of the production cycle and conversion costs are added uniformly throughout the production process. The FIFO method of process costing is used by Rest-a-Lot. Beginning work in process was 30% complete as to conversion costs, while ending work in process was 80% complete as to conversion costs.

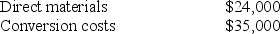

Beginning inventory:

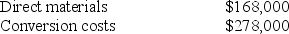

Manufacturing costs added during the accounting period:

Manufacturing costs added during the accounting period:

-How many of the units that were started during February were completed during February?

Definitions:

Common Size Statements

Financial statements that present all items in percentage terms; percentage of total assets for balance sheets and percentage of sales for income statements.

Common-base Year Financial Statement

A financial analysis technique where all values are presented relative to a specified base year, facilitating comparison over time.

Base Amount

The initial sum of money used as a reference or starting point for calculations, often related to financial calculations or transactions.

Sources of Cash

Various origins from which a business or individual can obtain funds, including operations, financing, and investing activities.

Q14: The Harleysville Manufacturing Shop produces motorcycle parts.

Q63: The static-budget variance is the difference between

Q73: The stage of the capital budgeting process

Q74: Under standard costing, there is no need

Q77: Costs in beginning inventory are pooled with

Q82: An important advantage of the net present

Q122: Which of the following INCORRECTLY reflects what

Q123: How many chairs were in inventory at

Q124: Six Sigma emphasizes incremental rather than dramatic

Q137: Using the stand-alone method with selling price