Answer the following questions using the information below:

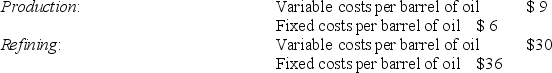

Penn Oil Corporation has two divisions, Refining and Production. The company's primary product is Luboil Oil. Each division's costs are provided below:

The Refining Division has been operating at a capacity of 40,000 barrels a day and usually purchases 25,000 barrels of oil from the Production Division and 15,000 barrels from other suppliers at $60 per barrel.

The Refining Division has been operating at a capacity of 40,000 barrels a day and usually purchases 25,000 barrels of oil from the Production Division and 15,000 barrels from other suppliers at $60 per barrel.

-Assume 200 barrels are transferred from the Production Division to the Refining Division for a transfer price of $18 per barrel. The Refining Division sells the 200 barrels at a price of $120 each to customers. What is the operating income of both divisions together?

Definitions:

Deductible Temporary Difference

Differences between the carrying amount of an asset or liability in the balance sheet and its tax base that will result in amounts deductible in future periods when recovering the carrying amount.

Deferred Tax Asset

An asset on the balance sheet that may be used to reduce future tax liability generated due to timing or temporary differences between accounting income and taxable income.

Future Tax

Taxes that are anticipated to be paid or recovered in future periods, often considered in financial projections and planning.

Deferred Tax Assets

These are amounts of income taxes recoverable in future periods due to deductible temporary differences, carry-forward of unused tax losses, and carry-forward of unused tax credits.

Q8: List and briefly describe each function in

Q13: Little Dog Unlimited makes small motorcycles. The

Q23: A trigger point refers to the inventory

Q55: The residual income method is the most

Q59: R&D, production, and customer service are business

Q59: Book & Bible Bookstore desires to buy

Q60: Cost of Quality financial measures will usually

Q73: Hardcover Company incurs the following costs when

Q88: A DISADVANTAGE of a negotiated transfer price

Q141: The primary criterion when faced with a