Answer the following questions using the information below:

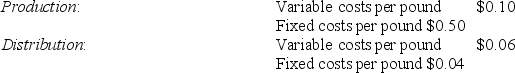

Greenlawn Corporation has two divisions, Distribution and Production. The company's primary product is fertilizer. Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,000,000 pounds a week and usually purchases 2,000,000 pounds from the Production Division and 2,000,000 pounds from other suppliers at $0.90 per pound.

The Distribution Division has been operating at a capacity of 4,000,000 pounds a week and usually purchases 2,000,000 pounds from the Production Division and 2,000,000 pounds from other suppliers at $0.90 per pound.

-What is the transfer price per barrel from the Production Division to the Distribution Division, assuming the method used to place a value on each pound of fertilizer is 120% of full costs?

Definitions:

Trapezius Group

The trapezius muscle group is a large muscle extending from the neck to the mid-back and across the shoulders, involved in moving, rotating, and stabilizing the scapula (shoulder blade) and extending the neck.

Vastus Intermedius

A deep muscle in the anterior compartment of the thigh, part of the quadriceps femoris group, lying between the vastus lateralis and vastus medialis.

Quadriceps Femoris

A significant muscular grouping, consisting of four dominant muscles located at the front of the thigh, crucial for extending the knee.

Ventrolateral Surface

Refers to the surface of an anatomical structure that is both toward the belly and the side.

Q9: Management control systems motivate managers and other

Q9: All accounting systems must assume that the

Q23: An actual cost is a predicted cost.

Q24: The after-tax average cost of all the

Q45: The net present value method can be

Q64: Discuss the cost-benefit approach guideline management accountants

Q90: The average waiting time is the average

Q90: A value proposition is a distinct benefit

Q102: Costs incurred in precluding the production of

Q110: The accrual accounting rate of return method