Answer the following questions using the information below:

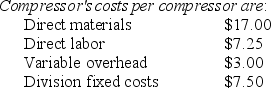

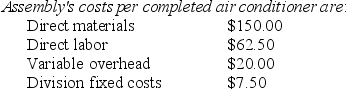

Calculate the Division operating income for the Artic Air Company which manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division. The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells it to retailers. The Compressor Division "sells" compressors to the Assembly Division. The market price for the Assembly Division to purchase a compressor is $38.50. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Assembly Division are assumed to be $7.50 per unit at 10,000 units.

-What is the market-based transfer price per compressor from the Compressor Division to the Assembly Division?

Definitions:

Total Revenue

The total amount of money a company receives from selling its goods or services before any expenses are subtracted.

Profit-Maximizing Output

The point of production where a company reaches its maximum profit, occurring when marginal revenue is equal to marginal cost.

Lawn-Mowing

The process of cutting the grass in a lawn to maintain a specified height and appearance.

Short-Run Supply Curve

A graphical representation showing how the quantity supplied varies with price in the short term, when at least one input is fixed.

Q32: Tax considerations should play no part in

Q60: Cost of Quality financial measures will usually

Q69: How many deliveries will be made during

Q76: The Coffee Division of American Products is

Q77: What is the Tractor Division's return on

Q83: A major weakness of comparing two companies

Q86: In an Economic Added Value calculation, the

Q110: The accrual accounting rate of return method

Q123: An example of a sunk cost in

Q135: What is the Digger Division's return on