Answer the following questions using the information below:

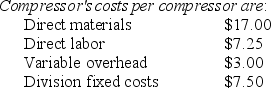

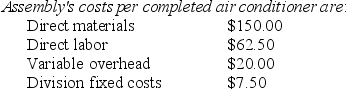

Calculate the Division operating income for the Artic Air Company which manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division. The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells it to retailers. The Compressor Division "sells" compressors to the Assembly Division. The market price for the Assembly Division to purchase a compressor is $38.50. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Assembly Division are assumed to be $7.50 per unit at 10,000 units.

-What is the transfer price per compressor from the Compressor Division to the Assembly Division if the method used to place a value on each compressor is 150% of variable costs?

Definitions:

Complementary Goods

Goods or services that are frequently utilized in conjunction with each other, leading to a scenario where the desire for one boosts the desire for the other.

Substitute Goods

Products or services that can be used in place of each other because they satisfy similar customer needs or desires.

Blu-Ray Players

Devices designed to play Blu-ray discs, which provide high-definition video and have more storage capacity than traditional DVDs.

Supply Curve

A visual diagram that illustrates the connection between a product's price and the amount of the product that sellers are prepared to offer.

Q48: Discuss the means by which a company

Q50: The accrual accounting rate-of-return method is similar

Q52: What are five features of a just-in-time

Q73: The stage of the capital budgeting process

Q88: Period costs are never included as part

Q101: Explain why a corporation's customer base is

Q102: Costs incurred in precluding the production of

Q125: Springfield Corporation, whose tax rate is 40%,

Q138: What were the sales for the Beta

Q164: Calculate last year's operating income when the