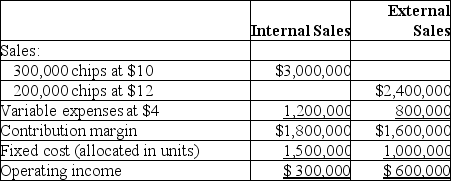

The Micro Division of Silicon Computers produces computer chips that are sold to the Personal Computer Division and to outsiders. Operating data for the Micro Division for 20X5 are as follows:

The Personal Computer Division has just received an offer from an outside supplier to furnish chips at $8.60 each. The manager of Micro Division is not willing to meet the $8.60 price. She argues that it costs her $9.00 to produce and sell each chip. Sales to outside customers are at a maximum of 200,000 chips.

The Personal Computer Division has just received an offer from an outside supplier to furnish chips at $8.60 each. The manager of Micro Division is not willing to meet the $8.60 price. She argues that it costs her $9.00 to produce and sell each chip. Sales to outside customers are at a maximum of 200,000 chips.

Required:

a. Verify the Micro Division's $9.00 unit cost figure.

b. Should the Micro Division meet the outside price of $8.60? Explain.

c. Could the $8.60 price be met and still show a profit for the Micro Division sales to the Personal Computer Division? Show computations.

Definitions:

Empty Nest

A phase in a parent's life when their children have grown up and left home, leading to an adjustment in living situation and roles.

Caregivers

Individuals who provide assistance and care to others, especially to children, elderly, or those with disabilities.

Income And Benefits

The monetary and non-monetary gains received by individuals or households, often from employment, which support their living expenses and lifestyle.

Retirement Planning

The process of preparing financially and socially for retirement, including savings, investments, and envisioning post-work life.

Q8: The $38,000 represents a(n):<br>A)activity cost pool<br>B)possible cost

Q10: ABC Boat Company is interested in replacing

Q17: Springtime Flower Company provides flowers and other

Q35: Should assets be defined as total assets

Q40: What is the net change in the

Q66: Capital budgeting is the process of making

Q86: What is the cycle time for an

Q95: Overtime premium is always a component of

Q105: When using a control chart, the observations

Q121: Required rate of return multiplied by the