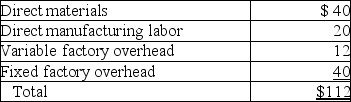

The Assembly Division of American Car Company has offered to purchase 90,000 batteries from the Electrical Division for $104 per unit. At a normal volume of 250,000 batteries per year, production costs per battery are as follows:

The Electrical Division has been selling 250,000 batteries per year to outside buyers at $136 each; capacity is 350,000 batteries per year. The Assembly Division has been buying batteries from outside sources for $130 each.

The Electrical Division has been selling 250,000 batteries per year to outside buyers at $136 each; capacity is 350,000 batteries per year. The Assembly Division has been buying batteries from outside sources for $130 each.

Required:

a. Should the Electrical Division manager accept the offer? Explain.

b. From the company's perspective, will the internal sales be of any benefit? Explain.

Definitions:

Nonprofit Credit Counselor

An advisor typically affiliated with a nonprofit organization who provides guidance on managing debt, budgeting, and improving personal financial health.

Chapter 13

A form of bankruptcy that allows individuals earning a regular income to develop a plan to repay all or part of their debts over time, usually three to five years.

Unsecured Debts

Obligations for which the borrower does not provide collateral, making them riskier for lenders.

Involuntary Bankruptcy

A legal procedure where creditors petition a court to declare a debtor bankrupt, without the debtor’s consent, in order to recoup some of the owed money.

Q20: Investment turnover is calculated as revenue divided

Q37: Which of the following FAIL to satisfy

Q43: No matter how low the transfer price,

Q68: The contribution margin is computed by deducting

Q84: In what way do managers benefit from

Q86: In an Economic Added Value calculation, the

Q93: Another term for benchmarking is a relative

Q110: To determine the Economic Order Quantity, the

Q113: What is the change in the daily

Q138: What were the sales for the Beta