Answer the following questions using the information below:

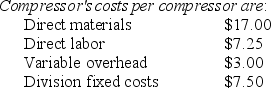

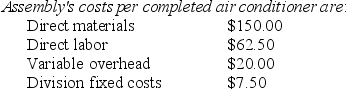

Calculate the Division operating income for the Artic Air Company which manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division. The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells it to retailers. The Compressor Division "sells" compressors to the Assembly Division. The market price for the Assembly Division to purchase a compressor is $38.50. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Assembly Division are assumed to be $7.50 per unit at 10,000 units.

-What is the market-based transfer price per compressor from the Compressor Division to the Assembly Division?

Definitions:

Computation

The process of performing mathematical or logical operations on data to transform, analyze, or generate new data.

Infinite Recursion

A condition where a function calls itself indefinitely, often leading to a stack overflow error.

Base Case

In recursive programming, the condition under which a recursive function returns without making any more recursive calls.

Recursive Valued Methods

Methods that call themselves with altered parameters to solve a problem, often used in programming for tasks like sorting and searching.

Q1: Farley Muffler Inc. received the following monthly

Q13: Sportswear Company manufactures sneakers. The Athletic Division

Q15: Capital investment decisions that are strategic in

Q26: The degree of freedom to make decisions

Q55: Just-in-time purchasing requires:<br>A)larger and less frequent purchase

Q71: How much will internal failure costs change,

Q83: Purchasing at the EOQ recommended level, what

Q94: Sandra's Sheet Metal Company has two divisions.

Q123: If scrap is returned to the company's

Q164: Calculate last year's operating income when the