Answer the following questions using the information below:

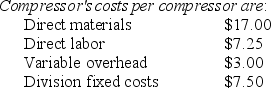

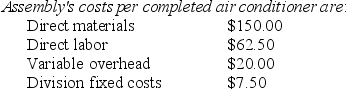

Calculate the Division operating income for the Artic Air Company which manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division. The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells it to retailers. The Compressor Division "sells" compressors to the Assembly Division. The market price for the Assembly Division to purchase a compressor is $38.50. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Assembly Division are assumed to be $7.50 per unit at 10,000 units.

-Assume the transfer price for a compressor is 150% of total costs of the Compressor Division and 1,000 of the compressors are produced and transferred to the Assembly Division. The Compressor Division's operating income is:

Definitions:

Q6: What is the Cyclotron Division's return on

Q18: Discuss a range of factors that managers

Q34: What is the EVA® for Brooksville?<br>A)$476,250<br>B)$428,000<br>C)$415,525<br>D)$390,000

Q43: In determining whether to keep a machine

Q56: Section 482 of the U.S. Internal Revenue

Q73: Warranty costs are an example of internal

Q98: Helmer Sporting Goods Company manufactured 100,000 units

Q108: In an Economic Value Added calculation, the

Q108: What is a supply chain, and what

Q126: Describe management accounting and financial accounting.