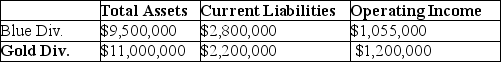

Springfield Corporation, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%, and equity capital with a market value of $12,000,000 and a cost of equity of 12%. Springfield has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:  What is Economic Value Added (EVA®) for the Blue Division?

What is Economic Value Added (EVA®) for the Blue Division?

Definitions:

Marginal Product

The additional output that can be produced by adding one more unit of a specific input, holding all other inputs constant.

Factor Market

A marketplace for the services of a factor of production, such as labor, capital, or land, where these are bought and sold.

Marginal Productivity

Refers to the increase in output that arises from an additional unit of input, assuming all other factors of production remain constant.

Marginal Productivity Theory

An economic theory suggesting that payment to factors of production equates to their marginal contribution to the output.

Q9: Coptermagic Company supplies helicopters to corporate clients.

Q14: Expected monetary value may be defined as<br>A)

Q22: In a backflush-costing system, no record of

Q26: Relevant opportunity cost of capital is the

Q34: CVP analysis requires the time value of

Q47: Which of the following statements about the

Q55: EIF Manufacturing Company needs to overhaul its

Q77: The theory of constraints is used for

Q106: What is the EVA® for Wichita?<br>A)$225,000<br>B)$765,000<br>C)$207,180<br>D)$557,820

Q110: Companies with a strategy of low prices