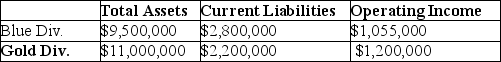

Springfield Corporation, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%, and equity capital with a market value of $12,000,000 and a cost of equity of 12%. Springfield has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:  Calculate EVA® for the Gold Division.

Calculate EVA® for the Gold Division.

Definitions:

M

A symbol often representing money supply in economic discussions, including various measures like M1, M2, and M3.

Q

Quantity, frequently used in economic equations and discussions to denote the amount of goods produced or consumed.

PQ

The product of price (P) and quantity (Q), often used in economics to calculate total revenue or expenditure.

P

Typically refers to "Price" in economic models, representing the monetary value assigned to a good or service in the market.

Q16: If planned net income is $21,000 and

Q17: Which of the following entries properly records

Q31: What is the reorder point?<br>A)1,040 units<br>B)857 units<br>C)1,560

Q32: Professional ethics for a Certified Management Accountant

Q80: Springfield Manufacturing produces electronic storage devices, and

Q93: The identify projects stage of capital budgeting

Q108: Optimal corporate decisions do NOT result when

Q110: The "balanced scorecard" in most organizations is

Q113: Which of the following is an example

Q123: Target net income is computed by multiplying