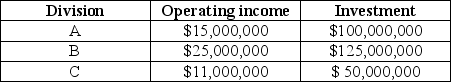

Capital Investments has three divisions. Each division's required rate of return is 15%. Planned operating results for 20X5 are as follows:

The company is planning an expansion, which will require each division to increase its investments by $25,000,000 and its income by $4,500,000.

The company is planning an expansion, which will require each division to increase its investments by $25,000,000 and its income by $4,500,000.

Required:

a. Compute the current ROI for each division.

b. Compute the current residual income for each division.

c. Rank the divisions according to their current ROIs and residual incomes.

d. Determine the effects after adding the new project to each division's ROI and residual income.

e. Assuming the managers are evaluated on either ROI or residual income, which divisions are pleased with the expansion and which ones are unhappy?

Definitions:

Q4: An increase in the tax rate will

Q12: The approach to capital budgeting which divides

Q38: Return on sales is calculated by dividing

Q44: The process of preparing a budget<br>A) enhances

Q61: What are Bleach's and Cleanser's residual incomes

Q72: What are the inventoriable costs per unit

Q107: Planning is choosing goals, predicting results under

Q113: A increase in the tax rate will

Q124: Explain when a manager would use cost-volume-profit

Q127: Blankinship, Inc., sells a single product. The