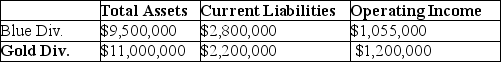

Springfield Corporation, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%, and equity capital with a market value of $12,000,000 and a cost of equity of 12%. Springfield has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:  What is Economic Value Added (EVA®) for the Blue Division?

What is Economic Value Added (EVA®) for the Blue Division?

Definitions:

Quasi Contract

An obligation imposed by law to prevent unjust enrichment, in the absence of an actual agreement between the parties involved.

Quasi Contract Theory

A legal concept that allows a court to award damages to a party as if a contract existed, even though one does not, to prevent unjust enrichment.

Nurse Practitioner

A healthcare professional with advanced training, capable of providing some level of care similar to that of a doctor, including diagnosing and treating conditions.

Unconscious

A state in which a person is not awake and not aware of and responding to their environment.

Q17: What is Frazer's cost of goods manufactured?<br>A)

Q43: The "four levers" of control are diagnostic

Q44: The stage of the capital budgeting process

Q47: Managers typically receive reports on cost planning

Q55: Cost based transfer prices are the only

Q73: Museum Corporation uses the investment center concept

Q82: An important advantage of the net present

Q90: The economic value added concept has attracted

Q130: In the analysis of a capital budgeting

Q137: A unit cost is computed by dividing