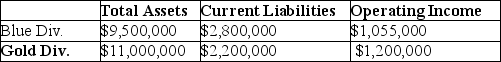

Springfield Corporation, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%, and equity capital with a market value of $12,000,000 and a cost of equity of 12%. Springfield has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:  Calculate EVA® for the Gold Division.

Calculate EVA® for the Gold Division.

Definitions:

Modeling

The process of representing real-life systems through mathematical formulas and simulations.

Social Withdrawal

The avoidance of social interactions and situations, often due to anxiety or preference for solitude.

Transference

A phenomenon in psychoanalysis whereby patients project feelings about important people from their past onto the therapist.

Exposure Therapies

Behavioral techniques that expose individuals to anxiety- or fear-related stimuli under carefully controlled conditions to promote new learning.

Q29: What is the operating income for each

Q35: Cost assignment is<br>A) always arbitrary.<br>B) linking actual

Q70: Control includes the performance evaluation of personnel

Q81: Xenon Autocar Company manufactures automobiles. The Fastback

Q87: What is the value of the operating

Q98: What is the total production per day

Q99: Managers use _ to create an ongoing

Q103: Assume you are evaluating a manufacturing company.

Q109: When considering the theory of constraints, operating

Q134: What are the differences between direct costs