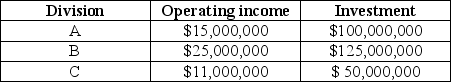

Capital Investments has three divisions. Each division's required rate of return is 15%. Planned operating results for 20X5 are as follows:

The company is planning an expansion, which will require each division to increase its investments by $25,000,000 and its income by $4,500,000.

The company is planning an expansion, which will require each division to increase its investments by $25,000,000 and its income by $4,500,000.

Required:

a. Compute the current ROI for each division.

b. Compute the current residual income for each division.

c. Rank the divisions according to their current ROIs and residual incomes.

d. Determine the effects after adding the new project to each division's ROI and residual income.

e. Assuming the managers are evaluated on either ROI or residual income, which divisions are pleased with the expansion and which ones are unhappy?

Definitions:

Capital Gain

The profit earned from the sale of an asset when the selling price exceeds its purchase price.

Book Value

The net asset value of a company, calculated as total assets minus intangible assets (patents, goodwill) and liabilities.

Income Taxes

Taxes on an individual's or corporation's income imposed by the government.

Modified Accelerated Cost Recovery System (MACRS)

The system of accelerated depreciation allowed for federal tax computations.

Q15: Market-based transfer prices are ideal when there

Q23: A trigger point refers to the inventory

Q40: "Cost management" describes<br>A) the actions by managers

Q50: In multi-product situations when sales mix shifts

Q51: The three alternatives for increasing return on

Q56: The final activity in the capital budgeting

Q94: Sandra's Sheet Metal Company has two divisions.

Q98: When using the historical cost of assets

Q113: What is the EVA® for Bish Bash

Q115: Managers and accountants gather the information that