Use the information below to answer the following question(s) .

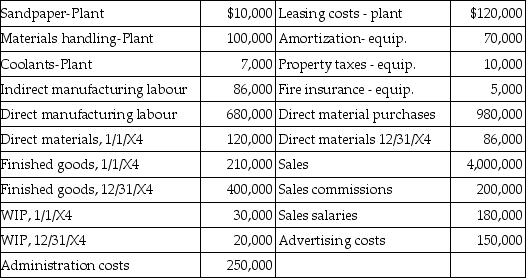

Consider the following data of the Vancouver Company for the year 20X4:

-What is the unit cost for the direct materials for 20X4 assuming direct materials are for the production of 507,000 units?

Definitions:

Sharpe Ratio

A measure to evaluate the performance of an investment compared to a risk-free asset, after adjusting for its risk. It’s calculated by subtracting the risk-free return from the return of the investment and dividing by the investment's standard deviation.

Small U.S. Stocks

Refers to shares of smaller companies in the United States, typically characterized by a lower market capitalization.

Long-Term U.S. Treasury Bonds

Government bonds with maturities typically longer than 10 years, considered among the safest investment securities.

Market Risk Premium

The excess return that investors require for choosing to invest in the stock market over a risk-free asset.

Q10: What is the cost driver rate if

Q10: What are the period costs per unit

Q18: What is the EVA® for St. Louis?<br>A)$127,870<br>B)$163,730<br>C)$196,270<br>D)$360,000

Q49: The process of getting a company's objectives

Q53: Costs of Sales is another way of

Q61: Inventoriable costs are reported as an asset

Q71: The value chain is the<br>A) sequence of

Q91: What is the EVA® for Stonybrook?<br>A)$1,108,000<br>B)$ 1,168,700<br>C)$

Q97: Using net book value as an investment

Q145: What is the unit cost for the