Use the information below to answer the following question(s) .

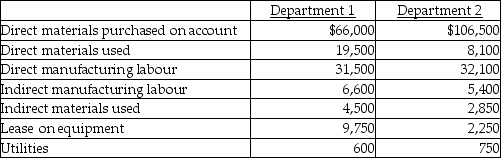

Jim's Computer Products manufactures keyboards for computers. In June, the two production departments had budgeted allocation bases of 10,000 machine hours in Department 1 and 5,000 direct manufacturing labour hours in Department 2. The budgeted manufacturing overheads for the month were $34,500 and $37,500, respectively. For Job 501, the actual costs incurred in the two departments were as follows:

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2. The company uses a budgeted departmental overhead rate for applying overhead to production.

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2. The company uses a budgeted departmental overhead rate for applying overhead to production.

-Sara employs 25 professional cleaners. Budgeted costs total $900,000 of which $525,000 are direct costs. Actual indirect costs were $396,900. Budgeted professional labour hours are 500,000 and actual hours were 525,000. What is the budgeted direct cost assignment rate?

Definitions:

Inventory Types

Categories of inventory such as raw materials, work-in-progress, finished goods, and maintenance, repair, and operations (MRO) supplies.

Maintenance/Repair/Operating Supply

Items and materials necessary for the upkeep and repair of operations, equipment, and facilities in an organization.

Safety Stock Inventory

A quantity of inventory kept on hand as a buffer against fluctuations in demand or supply.

Inventory Model

An analytical approach or mathematical formula used to manage and control stock levels, optimizing inventory costs and meeting demand.

Q14: Mannock Company budgeted $400,000 for employee training,

Q20: Human capital refers to the intangible skills

Q35: When using activity-based costing in a manufacturing

Q36: Arthur's Plumbing reported the following:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2722/.jpg"

Q40: Ballpark Concessions currently sells hot dogs. During

Q53: Costs of Sales is another way of

Q64: Stretch goals in budgeting tend to<br>A) decrease

Q72: What are the inventoriable costs per unit

Q110: When 50,000 units are produced the fixed

Q113: A job costing system assigns costs to