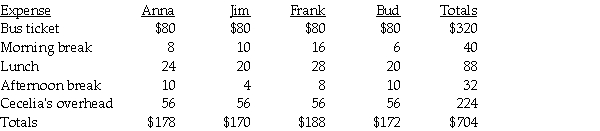

Cecelia Schell is taking four clients (who are not related) on a tour of her retirement development. The clients incurred the following expenses while on the tour. All tour expenses are paid by Cecelia because she has business discounts for most of her business dealings. These expenses will be billed to the clients by Cecelia.

Required:

Required:

Compute the total average cost per client showing average indirect (overhead) and average direct (other) charges separately.

Definitions:

Taxpayers

Individuals and entities that are required to pay taxes to government authorities, based on income, property ownership, or consumption.

Export Subsidies

Financial support from the government to companies for the purpose of encouraging exports of goods to foreign countries.

Agricultural Products

Goods derived from farming and agriculture, including food items, feed, fiber, and biofuel commodities.

Tariffs

Taxes imposed by a government on imported or occasionally exported goods, often used to protect domestic industries from foreign competition.

Q10: Everjoice Company makes clocks. The budgeted fixed

Q13: What is the "operating income" assuming 250

Q33: Gates Rubber Company sells cases of hydraulic

Q41: Calculate the flexible-budget variance for variable setup

Q45: Office Supply Company manufactures office furniture. Recently

Q61: Calculate the rate variance for variable setup

Q73: Video Producers manufactures two types of videos:

Q94: Spirit Company sells three products with the

Q103: Coffey Company maintains a very large direct

Q155: Big Bird Pet Store had the following