Use the information below to answer the following question(s) .

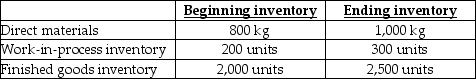

Marguerite Inc.. expects to sell 20,000 pool cues for $20.00 each. Direct materials costs are $2.00, direct manufacturing labour is $12.00, and manufacturing overhead is $0.80 per pool cue. Each pool cue requires 0.5 kilograms (kg) of material which is all added at the start of production. The units in work-in-process beginning and ending inventory were half complete as to direct labour and manufacturing overhead costs; the units in beginning inventory are completed before new units are started.. Each pool cue requires one hour of direct labour, and manufacturing overhead is allocated based on direct labour hours. The following inventory levels are expected to apply to 2012:

-On the 2012 budgeted income statement, what amount will be reported for cost of goods sold?

Definitions:

Excess Annual Amortization

Excess annual amortization refers to the amount of amortization expense that exceeds the expected or standard amount within a given year, often related to intangible assets.

Intra-entity Gain

The profit recognized from transactions occurring within the same legal entity or between affiliated entities under common control, often requiring elimination for consolidation purposes.

Trademarks

Identifiable symbols, names, or expressions legally registered or established by use as representing a company or product.

Proportionate Book Value

An approach to valuing a company based on the book value of its assets and liabilities, adjusted proportionally for partial interests.

Q3: The contribution margin method of CVP analysis

Q31: Nicholas Company manufacturers TVs. Some of the

Q65: What is the practical capacity for the

Q84: Companies with a greater proportion of fixed

Q89: July's direct manufacturing labour price variance is<br>A)

Q112: One of the benefits of an ABC

Q123: It's year-end and you have the task

Q124: The main advantage of using budgeted cost

Q137: What are the 2012 budgeted costs for

Q148: The financial budget is that part of