Use the information below to answer the following question(s) .

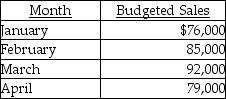

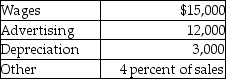

Grinnell Manufacturing Company has the following information for 2012:

Budget Expenses per Month

Budget Expenses per Month

Note: All cash expenses are paid as incurred; Collections from sales are 50% in the month of sale and 50% in the month following the sale; December 2011 sales were $110,000.

Note: All cash expenses are paid as incurred; Collections from sales are 50% in the month of sale and 50% in the month following the sale; December 2011 sales were $110,000.

-What is the budgeted net operating income for the first quarter of 2012?

Definitions:

Finished Goods Inventory

Products that have completed the manufacturing process and are ready for sale.

Indirect Labor

Labor costs not directly associated with the production of goods or the performance of a specific task, such as maintenance and administrative staff salaries.

Overhead Applied

The allocation of overhead costs to specific cost objects, such as products or projects, based on a predetermined rate or method.

Direct Labor Costs

Expenses directly associated with the labor used in the production of goods or services, including wages and benefits for manufacturing or service employees.

Q12: To prepare budgets based on actual data

Q15: What is the total manufacturing cost of

Q20: The type of budget that is based

Q55: If a company has a favourable efficiency

Q69: The coefficient of determination (r<sup>2</sup>) measures the

Q77: The materials yield variance will be unfavourable

Q78: The production-volume variance arises because the actual

Q94: Spirit Company sells three products with the

Q109: The costs of hiring building security would

Q111: The production budget of a manufacturing company