Use the information below to answer the following question(s) .

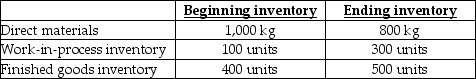

Daniel Inc. expects to sell 6,000 ceramic vases for $20 each in 2012. Direct materials costs are $2, direct manufacturing labour is $10, and manufacturing overhead is $3 per vase. Each vase requires 0.5 kilograms (kg) of material which is all added at the start of production. The units in work-in-process beginning and ending inventory were half complete as to direct labour and manufacturing overhead costs; the units in beginning inventory are completed before new units are started. Each vase requires one hour of direct labour, and manufacturing overhead is allocated based on direct labour hours. The following inventory levels are expected to apply to 2012:

-On the 2012 budgeted income statement, what amount will be reported for cost of goods sold?

Definitions:

Financial Plan

An in-depth analysis of a person's present and potential financial condition, utilizing existing data to forecast future earnings, the value of assets, and strategies for withdrawals.

Capital Structure Policy

The strategy or approach a company takes in balancing its debt and equity financing to optimize its capital structure.

Net Working Capital

The difference between a company's current assets and its current liabilities, indicating the short-term financial health and operational efficiency of a company.

Capital Budgeting Decisions

The process of planning and managing a company's long-term investments in major projects or assets.

Q7: "Uncertainty" may be defined as<br>A) the possibility

Q8: How many chests should be budgeted to

Q18: The break-even point in CVP analysis is

Q47: The difference between budgeted fixed manufacturing overhead

Q98: How much of the correspondence cost will

Q103: A cost hierarchy is a categorization of

Q108: What are three possible ways to dispose

Q109: Jael Equipment uses a flexible budget for

Q131: When calculating the total amount of manufacturing

Q138: June's direct material flexible-budget variance is<br>A) $980