Use the information below to answer the following question(s) .

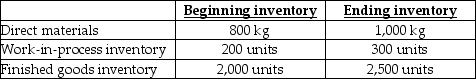

Marguerite Inc.. expects to sell 20,000 pool cues for $20.00 each. Direct materials costs are $2.00, direct manufacturing labour is $12.00, and manufacturing overhead is $0.80 per pool cue. Each pool cue requires 0.5 kilograms (kg) of material which is all added at the start of production. The units in work-in-process beginning and ending inventory were half complete as to direct labour and manufacturing overhead costs; the units in beginning inventory are completed before new units are started.. Each pool cue requires one hour of direct labour, and manufacturing overhead is allocated based on direct labour hours. The following inventory levels are expected to apply to 2012:

-On the 2012 budgeted income statement, what amount will be reported for cost of goods sold?

Definitions:

Adjusting Entry

Accounting records created at the closing of a fiscal period to distribute expenses and revenues to the time they were truly incurred.

General Journal

A basic accounting ledger used to record all types of accounting transactions before they are transferred to specific accounts in the general ledger.

Cash Receipts Journal

A specialized accounting journal used in the double-entry bookkeeping system to keep track of all cash transactions that increase (debit) the cash account.

Horizontal Analysis

This involves comparing financial data over a series of reporting periods to identify trends and growth patterns within a company's operations.

Q8: How many actions and alternatives exist in

Q57: Mount Carmel Company sells only two products,

Q71: What is the direct materials price variance

Q76: Managers generally have more control over efficiency

Q91: The direct materials mix variance is the<br>A)

Q100: Whistler Table Company manufactures tables for schools.

Q107: Calculate the production-volume variance for fixed setup

Q118: Which of the following statements is true?<br>A)

Q136: The main difference between variable costing and

Q147: When applied to budgets, responsibility accounting provides