Use the information below to answer the following question(s) .

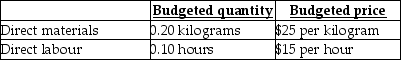

Sawyer Industries Inc. (SII) , developed standard costs for direct material and direct labour. In 2013, SII estimated the following standard costs for one of their major products, the 30-litre heavy-duty plastic container.

During July, SII produced and sold 10,000 containers using 2,200 kilograms of direct materials at an average actual cost per kilogram of $24 and 1,050 direct manufacturing labour hours at an average actual wage of $14.75 per hour.

During July, SII produced and sold 10,000 containers using 2,200 kilograms of direct materials at an average actual cost per kilogram of $24 and 1,050 direct manufacturing labour hours at an average actual wage of $14.75 per hour.

-July's direct material price variance is

Definitions:

Beginning of the Year

Refers to the start of a fiscal or calendar year, marking the time frame used for financial and operational planning and analysis.

Predetermined Overhead Rate

A rate calculated before a period begins, used to assign manufacturing overhead costs to products based on a relevant activity base.

Manufacturing Overhead Applied

The portion of manufacturing overhead costs allocated to each unit of production based on a predetermined rate.

Cost of Goods Sold

The direct costs attributable to the production of the goods sold by a company, including materials, labor, and manufacturing overhead.

Q4: A process costing system assigns costs to

Q18: Using _ capacity fixes the cost of

Q26: The cash cycle describes the movement of

Q31: Which of the following is one of

Q53: What indirect costs were accumulated for each

Q60: The fixed manufacturing overhead efficiency variance is

Q68: On the 2012 budgeted income statement, what

Q71: What is the ending cash balance for

Q110: A standard is<br>A) usually expressed on a

Q129: Which of the following is not a