Use the information below to answer the following question(s) .

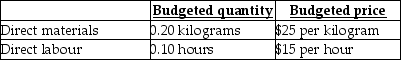

Sawyer Industries Inc. (SII) , developed standard costs for direct material and direct labour. In 2013, SII estimated the following standard costs for one of their major products, the 30-litre heavy-duty plastic container.

During July, SII produced and sold 10,000 containers using 2,200 kilograms of direct materials at an average actual cost per kilogram of $24 and 1,050 direct manufacturing labour hours at an average actual wage of $14.75 per hour.

During July, SII produced and sold 10,000 containers using 2,200 kilograms of direct materials at an average actual cost per kilogram of $24 and 1,050 direct manufacturing labour hours at an average actual wage of $14.75 per hour.

-July's direct material price variance is

Definitions:

Price Elasticity

The calculation of how price alterations affect the demand level of a good.

Excise Tax

A specific type of tax levied on particular goods, services, or transactions, often included in the price of items such as gasoline, alcohol, and tobacco.

Taxable Income

The portion of an individual's or a corporation's income that is subject to taxes according to governmental regulations.

Marginal Tax Rate

The tax rate that applies to the next dollar of taxable income, indicating the percentage of any additional income that will be paid in taxes.

Q19: The budgeted fixed manufacturing cost rate is

Q70: What is the variable costing break-even point

Q78: The production-volume variance arises because the actual

Q81: Variable manufacturing costs are accounted for in

Q89: What is the cost per bouquet if

Q99: Russell Company has the following projected account

Q107: Calculate the production-volume variance for fixed setup

Q112: What is the total manufacturing cost of

Q130: What is the price variance of the

Q132: The variable overhead flexible-budget variance can be