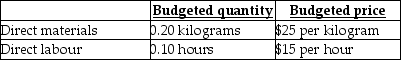

Use the information below to answer the following question(s) .Sawyer Industries Inc.(SII) , developed standard costs for direct material and direct labour.In 2019, SII estimated the following standard costs for one of their major products, the 30-litre heavy-duty plastic container.  During July 2020, SII produced and sold 10,000 containers using 2,200 kilograms of direct materials at an average actual cost per kilogram of $24 and 1,050 direct manufacturing labour hours at an average actual wage of $14.75 per hour.

During July 2020, SII produced and sold 10,000 containers using 2,200 kilograms of direct materials at an average actual cost per kilogram of $24 and 1,050 direct manufacturing labour hours at an average actual wage of $14.75 per hour.

-July's direct manufacturing labour flexible-budget variance is

Definitions:

Guaranteed Payments

Guaranteed Payments are payments made by a partnership to a partner for services or capital investment, which are not dependent on the partnership's income.

Separately Stated

Items on a tax return or financial statement that are listed individually to identify their specific impact on taxation or financial analysis.

Partnership Interest

An ownership share in a partnership that represents a partial right to its assets, income, and gains.

Outside Basis

Refers to a partner's or investor's tax basis in an individual partnership interest or investment, including the initial investment amount plus any additional contributions and adjusted by allocations of income or loss and distributions.

Q20: A refined costing system results in a

Q26: Inaccurate product costs can expose a company

Q28: A machine shop has direct materials cost

Q48: Spurious correlation refers to a repetitive coincidence

Q69: The coefficient of determination (r<sup>2</sup>) measures the

Q74: When benchmarking,<br>A) the best levels of performance

Q97: A major concern that arises with multiple

Q114: It is best to compare this year's

Q119: How many pool cues need to be

Q127: Determining what activities add customer value is