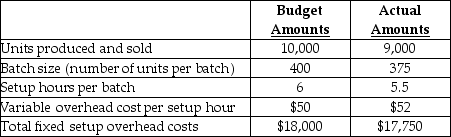

Answer the following question(s) using the information below.Lukehart Industries Inc.produces air purifiers in batches.To manufacture a batch of the purifiers Lukehart Inc.must setup the machines and assembly line tooling.Setup costs are batch-level costs because they are associated with batches rather than individual units of products.A separate Setup Department is responsible for setting up machines and tooling for different models of the air purifiers.Setup overhead costs consist of some costs that are variable and some costs that are fixed with respect to the number of setup hours.The following information pertains to June 2012:

-Calculate the rate variance for fixed setup overhead costs.

Definitions:

Operations

Refers to the day-to-day activities involved in running a business, including production, sales, and administration functions.

Variable Costing

An accounting method that only includes variable costs in the cost of goods sold and analyzes fixed costs separately.

Contribution Margin

The amount remaining from sales revenue after variable costs have been deducted, indicating how much contributes to covering fixed costs and generating profit.

Manufacturing Margin

The difference between the sales revenue generated from manufactured goods and the cost of goods sold (COGS), highlighting the profitability of manufacturing activities.

Q13: Which of the following describes the intercept

Q26: Which of the following concepts is most

Q27: Relevant costs for pricing decisions include manufacturing

Q33: Kirkland Company manufactures a part for use

Q79: When managers are faced with constraints the

Q81: A rolling budget encourages management to be

Q93: The direct materials yield variance is the

Q94: A better database for estimating cost functions

Q109: Using the high-low method, the cost function

Q110: Regal Company uses a single cost pool