Answer the following question(s) using the information below.

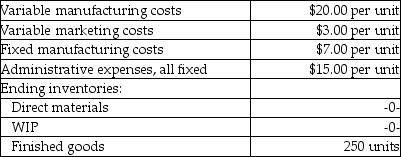

Peggy's Pillows produces and sells a decorative pillow for $75.00 per unit. In the first month of operation, 2,000 units were produced and 1,750 units were sold. Actual fixed costs are the same as the amount budgeted for the month. Other information for the month includes:

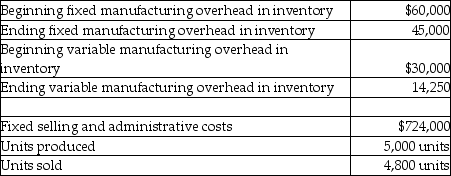

-The following information pertains to Brian Stone Corporation:  What is the difference between operating incomes under absorption costing and variable costing?

What is the difference between operating incomes under absorption costing and variable costing?

Definitions:

Overapplied Manufacturing Overhead

A situation where the allocated manufacturing overhead costs exceed the actual overhead costs incurred.

Adjusted Cost

The net cost of an asset after adjustments for factors such as depreciation, improvements, or disposals, used in financial and tax reporting.

Cost of Goods Manufactured

Cost of Goods Manufactured (COGM) is the total production cost of goods completed during a specific period, including materials, labor, and overhead costs.

Schedule of Cost

A detailed listing of costs incurred for a project or production, often categorized by type or department.

Q27: Relevant costs for pricing decisions include manufacturing

Q29: Which of the following is a measure

Q47: What production level is required for Day

Q58: Which of the following criteria should be

Q59: Survey evidence suggest that most companies use

Q86: Pam's Stables used two different predictor variables

Q87: Which of the following best describes the

Q103: Electrical Engineering Equipment Ltd. purchased a machine

Q113: Which of the following statements is true?<br>A)

Q145: Lewis Auto Company manufactures a part for