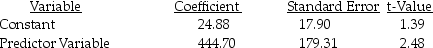

Review the following report of the results of a simple regression program for cost estimation.

r2 = 0.72

r2 = 0.72

Required:

a. What is the cost estimation equation according to the report?

b. What is the goodness of fit? What does it tell about the estimating equation?

Definitions:

Strike Price

The strike price is a predetermined price at which the holder of an option can buy (call option) or sell (put option) the underlying asset until the expiration date.

Current Price

The present value or selling price of an asset, security, or commodity available in the marketplace.

Put Option

A financial contract that gives the holder the right, but not the obligation, to sell a specified amount of an underlying asset at a set price within a specified time.

Strike Price

The predetermined price at which the buyer of a call option can purchase the underlying asset, or the buyer of a put option can sell the underlying asset.

Q43: Reengineering is the fundamental rethinking and redesign

Q48: Identify and explain Porter's Five Forces model.

Q51: What were total fixed costs for 2012?

Q60: Using the high-low method determine the constant

Q75: Managers have found that non-financial measures provide

Q105: Give at least three good reasons why

Q105: The difference between the actual amount of

Q115: _ translates an organization's mission and strategy

Q117: Effective planning of variable overhead costs means

Q147: The following information pertains to Brian Stone