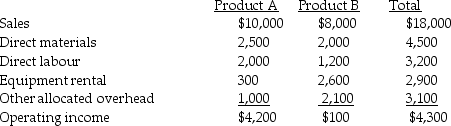

Clinton Company sells two items, product A and product B. The company is considering dropping product B. It is expected that sales of product A will increase by 40% as a result. Dropping product B will allow the company to cancel its monthly equipment rental costing $100 per month. The other existing equipment will be used for additional production of product A. One employee earning $200 per month can be terminated if product B production is dropped. Clinton's other fixed costs are allocated and will continue regardless of the decision made. A condensed, budgeted monthly income statement with both products follows:

Required:

Required:

Prepare an incremental analysis to determine the financial effect of dropping product B.

Definitions:

Variable Costing

An accounting method in which variable manufacturing costs are included in product costs, while fixed manufacturing overhead is treated as an expense of the current period.

Net Operating Income

A financial metric that calculates a company's income after operating expenses are deducted, but before interest and taxes are subtracted.

Direct Material Cost

The expense of fundamental materials directly utilized in the production of a product.

Product Cost

The total amount of costs directly and indirectly involved in manufacturing a product or delivering a service.

Q2: What is the predicted indirect manufacturing labour

Q18: When benchmarking, the best levels of performance

Q28: What is the target cost for each

Q38: Maloney Corporation manufactures plastic water bottles. It

Q95: A local accounting firm has offered to

Q102: Axle and Wheel Manufacturing is approached by

Q110: Once a cost pool has been established,

Q116: Short-run pricing decisions include adjusting product mix

Q122: Vinetta Ltd. provided the following information: <img

Q154: What are break-even sales in units using