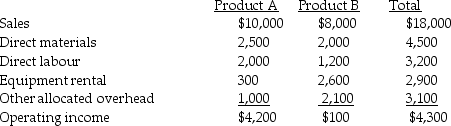

Clinton Company sells two items, product A and product B. The company is considering dropping product B. It is expected that sales of product A will increase by 40% as a result. Dropping product B will allow the company to cancel its monthly equipment rental costing $100 per month. The other existing equipment will be used for additional production of product A. One employee earning $200 per month can be terminated if product B production is dropped. Clinton's other fixed costs are allocated and will continue regardless of the decision made. A condensed, budgeted monthly income statement with both products follows:

Required:

Required:

Prepare an incremental analysis to determine the financial effect of dropping product B.

Definitions:

Liquidity

The ease with which assets can be converted into cash without significantly affecting their value.

Current Ratio

A liquidity ratio that measures a company's ability to pay short-term obligations with its current assets over current liabilities.

Acid Test Ratio

A financial metric that assesses a company's ability to pay off its short-term liabilities with its quick assets (cash, marketable securities, and receivables).

Current Assets

Assets that are expected to be converted into cash within one fiscal year or one operating cycle, whichever is longer.

Q6: Which of the following journal entries is

Q21: Multicollinearity exists in multiple linear regression when

Q24: Assume that variable manufacturing overhead is allocated

Q38: For short-term pricing decisions, what costs are

Q51: _ is the level of capacity based

Q51: Companies that have been successful at cost

Q63: What is the target cost if target

Q109: Using the high-low method, the cost function

Q114: Opportunity cost is the contribution to income

Q135: What is the variable manufacturing overhead efficiency