Answer the following question(s) using the information below.

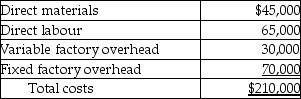

Schmidt Corporation produces a part that is used in the manufacture of one of its products. The costs associated with the production of 10,000 units of this part are as follows:

Of the fixed factory overhead costs, $30,000 is avoidable.

Of the fixed factory overhead costs, $30,000 is avoidable.

-Assuming accepting the offer creates excess facility capacity that can be used to produce 2,000 units of another product that has a unit selling price of $24, variable costs of $12, and fixed cost allocation of $3. What is the highest price that Schmidt should be willing to pay Phil Company for 10,000 units of the part?

Definitions:

Zero-Coupon Bond

Is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, providing profit at maturity when the bond is redeemed for its full face value.

Rate Of Return

The gain or loss on an investment over a specified time period, expressed as a percentage of the investment’s cost.

Break-Even Interest Rate

The interest rate at which an investment generates returns that are sufficient to cover the costs associated with the investment, resulting in a net profit of zero.

Zero-Coupon Bond

A bond that does not pay interest during its life but is sold at a discount and pays its full face value at maturity.

Q50: Two entities, Burch Company and Carey Company,

Q51: Timothy Company has budgeted sales of $780,000

Q56: The allocation of one particular cost must

Q58: What is Moeller Electric's variable manufacturing overhead

Q60: Should a company with high fixed costs

Q69: Regal Company uses a single cost pool

Q91: Which of the following statements about the

Q103: What is the primary reason a firm

Q109: What is the unit cost for establishing

Q114: Master-budget capacity utilization can be more reliably