Use the information below to answer the following question(s).

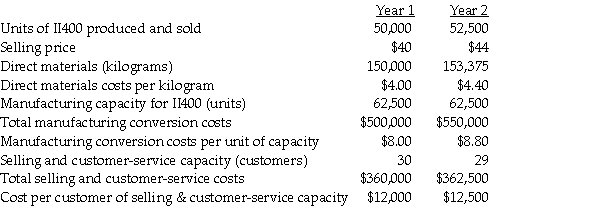

Following a strategy of product differentiation,Instruments Inc.makes a hand held calculator,II400.Instruments Inc.presents the following data for the years 1 and 2:

Instruments Inc.produces no defective units but it wants to reduce direct materials usage per unit of II400 in year 2.Manufacturing conversion costs in each year depend on production capacity defined in terms of II400 units that can be produced.Selling and customer-service costs depend on the number of customers that the customer and service functions are designed to support.Neither conversion costs or customer-service costs are affected by changes in actual volume.Instruments Inc.has 23 customers in year 1 and 25 customers in year 2.The industry market size for hand held calculators increased 5% from year 1 to year 2.Of the $4 increase in unit selling price,$1 is due to a general increase in prices.

Instruments Inc.produces no defective units but it wants to reduce direct materials usage per unit of II400 in year 2.Manufacturing conversion costs in each year depend on production capacity defined in terms of II400 units that can be produced.Selling and customer-service costs depend on the number of customers that the customer and service functions are designed to support.Neither conversion costs or customer-service costs are affected by changes in actual volume.Instruments Inc.has 23 customers in year 1 and 25 customers in year 2.The industry market size for hand held calculators increased 5% from year 1 to year 2.Of the $4 increase in unit selling price,$1 is due to a general increase in prices.

-Required:

a.What amount is the revenue effect of the price-recovery component?

b.What amount is the cost effect of the price-recovery component?

c.What is the net change in operating income as a result of the price-recovery component?

Definitions:

Liquid Assets

Assets that can be quickly converted into cash without significant loss of value, facilitating financial flexibility.

Plant and Equipment

Tangible long-term assets owned by a business, used in the production or supply of goods and services.

Goodwill

An intangible asset that arises when a business is acquired for more than its fair market value, reflecting factors like reputation, brand, and customer loyalty.

Net Working Capital

The difference between a company's current assets and its current liabilities, indicating the liquidity and operational efficiency of the business.

Q9: Compute the estimated costs for each of

Q25: Managers tend to favour decision choices that

Q43: Using the stand-alone method with manufacturing cost

Q49: A major deficiency of the sales value

Q64: Under the stand-alone method, which weights better

Q75: The cause-and-effect criterion is not present when

Q76: Cost items that do not change between

Q127: An electronics manufacturer is trying to encourage

Q138: Anticipated future costs that differ with alternative

Q145: Benefits from using a well-designed cost allocation