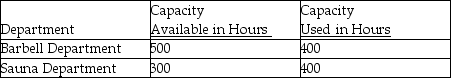

Use the information below to answer the following question(s) .We Be Warehouse Fitness Equipment incurred $80,000 of common fixed costs and $120,000 of common variable costs.Data are provided below for the capacity allowed and the capacity used.  For both departments, common fixed costs are to be allocated on the basis of capacity available and common variable costs are to be allocated on the basis of capacity used.

For both departments, common fixed costs are to be allocated on the basis of capacity available and common variable costs are to be allocated on the basis of capacity used.

-The fixed and variable costs allocated to the Barbell Department are

Definitions:

Government Expenditures

Financial spending by government agencies on goods, services, and public projects to fulfill their various roles and responsibilities.

Federal Tax Structure

The system by which the U.S. government finances its operations through the imposition of taxes on individuals, corporations, and other entities, including income tax, corporate tax, and sales tax.

Average Tax Rate

The ratio of the total amount of taxes paid to the total income of the taxpayer, showing the percentage of income paid in taxes.

Regressive

Pertaining to a tax system where the tax rate decreases as the taxable amount increases, placing a higher burden on lower-income individuals.

Q1: Four Seasons Company makes snow blowers. Materials

Q12: The cost of visiting customers is an

Q18: The fixed costs of operating the maintenance

Q70: When the actual mix of products sold

Q115: Learning-4-Fun provides materials that let people teach

Q125: For each of the following items tell

Q127: Successful reengineering efforts generally involve changing the

Q130: Germaine Company provided the following information. <img

Q143: One of the purposes of allocating indirect

Q144: Which statement is NOT true regarding the