Use the information below to answer the following question(s) .

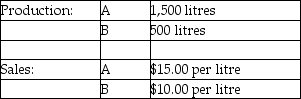

Beverage Drink Company processes direct materials up to the split off point, where two products, A and B, are obtained. The following information was collected for the month of July:

Direct materials processed: 2,500 litres (with 20 percent shrinkage)

Cost of purchasing 2,500 litres of direct materials and processing it up to the split off point to yield a total of 2,000 litres of good products was $4,500. There were no inventory balances of A and B.

Cost of purchasing 2,500 litres of direct materials and processing it up to the split off point to yield a total of 2,000 litres of good products was $4,500. There were no inventory balances of A and B.

Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150. Product Z5 is sold for $25.00 per litre. There was no beginning inventory and ending inventory was 125 litres.

Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275. Product W3 is sold for $30.00 per litre. There was no beginning inventory and ending inventory was 25 litres.

-What is Product B's estimated sales value at the split off point?

Definitions:

Title VII

Title VII is a section of the Civil Rights Act of 1964 in the United States that prohibits employment discrimination based on race, color, religion, sex, or national origin.

Indian Tribes

Indigenous peoples recognized by the federal government as sovereign entities with certain self-governing powers and rights.

Private Employers

Individuals or entities that operate businesses or organizations not owned or controlled by the government, employing staff in the private sector.

ADEA

The Age Discrimination in Employment Act, a US federal law that aims to protect workers and job applicants who are 40 years of age or older from employment discrimination.

Q2: There are multiple cost objects in most

Q4: Units of production that can be reprocessed

Q8: What is the static budget variance (contribution

Q32: Which of the following is False concerning

Q49: Profit margins are often set to earn

Q72: BIG Manufacturing Products has been using FIFO

Q76: An organization that is using the product

Q94: Marvin Ltd. uses an automated process in

Q114: How many units must be accounted for

Q138: The fixed and variable costs allocated to