Use the information below to answer the following question(s) .

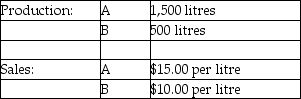

Beverage Drink Company processes direct materials up to the split off point, where two products, A and B, are obtained. The following information was collected for the month of July:

Direct materials processed: 2,500 litres (with 20 percent shrinkage)

Cost of purchasing 2,500 litres of direct materials and processing it up to the split off point to yield a total of 2,000 litres of good products was $4,500. There were no inventory balances of A and B.

Cost of purchasing 2,500 litres of direct materials and processing it up to the split off point to yield a total of 2,000 litres of good products was $4,500. There were no inventory balances of A and B.

Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150. Product Z5 is sold for $25.00 per litre. There was no beginning inventory and ending inventory was 125 litres.

Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275. Product W3 is sold for $30.00 per litre. There was no beginning inventory and ending inventory was 25 litres.

-What is Product Z5's and Product W3's respective production cost per unit, assuming the company allocates joint costs on the basis of net realizable value?

Definitions:

Product Innovation

The process of developing new products or improving existing ones to meet changing consumer needs and preferences.

Process Innovation

The implementation of new or significantly improved production or delivery methods, enhancing efficiency or quality in the manufacturing or service sectors.

Venture Capital

Financing provided by investors to startups and small businesses with long-term growth potential.

Time Horizon

The length of time over which an investment, project, or policy is intended or expected to occur or be effective.

Q19: Seneca Company has invested $1,000,000 in a

Q28: Vestor Ltd. has estimated a 90% incremental

Q33: Describe three objectives of a costing system.

Q74: Which of the following statements is true

Q81: John Peters is drafting the provisions of

Q93: If the market-size variance is $400 U

Q96: List the reasons that the sales value

Q103: The sales-volume variance is favourable assuming the

Q105: Which of the following methods allocates joint

Q107: The estimated net realizable value method allocates