Use the information below to answer the following question(s) .

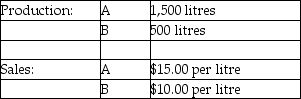

Beverage Drink Company processes direct materials up to the split off point, where two products, A and B, are obtained. The following information was collected for the month of July:

Direct materials processed: 2,500 litres (with 20 percent shrinkage)

Cost of purchasing 2,500 litres of direct materials and processing it up to the split off point to yield a total of 2,000 litres of good products was $4,500. There were no inventory balances of A and B.

Cost of purchasing 2,500 litres of direct materials and processing it up to the split off point to yield a total of 2,000 litres of good products was $4,500. There were no inventory balances of A and B.

Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150. Product Z5 is sold for $25.00 per litre. There was no beginning inventory and ending inventory was 125 litres.

Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275. Product W3 is sold for $30.00 per litre. There was no beginning inventory and ending inventory was 25 litres.

-What is Product Z5's and Product W3's respective production cost per unit, assuming the company allocates joint costs on the basis of net realizable value?

Definitions:

Horizontal Ruler

A graphical user interface tool that displays horizontal measurement markings, often used in document editing or design applications.

Format Painter

A feature in many Microsoft applications that allows users to quickly apply the same formatting, such as color, font style, and size, from one part of a document to another.

Form Layout View

A design surface in database applications that allows for the arrangement and customization of forms for data entry and display.

Outline Color

A property that specifies the color of the border or outline of a graphical element on a user interface.

Q15: How many units remain in ending work-in-process,

Q21: An activity-based costing system may focus on

Q27: Calculate the revenue allocation for Game A

Q60: Recognition of byproducts in the financial statements

Q67: Explain the difference between locked in costs

Q89: Using the physical measures method, the weightings

Q101: _ is an organization's ability to offer

Q106: Using the sales value at splitoff method,

Q131: Sweet Sugar Company processes sugar beets into

Q131: What is Acorn's target selling price if