Answer the following question(s) using the information below:

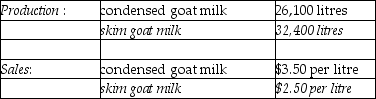

The Morton Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result.The following information was collected for the month of October:

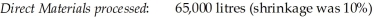

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240.There were no inventory balances of either product.Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre.Xyla can be sold for $18 per litre.Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50.The product can be sold for $9 per litre.There are no beginning and ending inventory balances.

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240.There were no inventory balances of either product.Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre.Xyla can be sold for $18 per litre.Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50.The product can be sold for $9 per litre.There are no beginning and ending inventory balances.

-What is the estimated net realizable value of the skim goat ice cream at the splitoff point?

Definitions:

Video Résumés

A digital form of CV presented via video to showcase a candidate's skills and personality to potential employers.

Public Speaking

The act of performing a speech to a live audience with the aim of informing, persuading, or entertaining.

Technical Skills

Specific abilities or expertise related to a particular field or profession, often requiring specialized knowledge or training.

Production Goal

A specific target or objective set for the output or results of the production process within a given timeframe.

Q30: Normal spoilage rates for a manufacturing process

Q72: A byproduct is one or more products

Q74: Required:<br>a. What is the net effect on

Q77: What are the amounts of direct materials

Q81: List and describe the five steps in

Q85: The production manager for Towns Ltd., Scott

Q92: The Alex Miller Corporation operates one central

Q97: A product's markup percentage would need to

Q108: The stand-alone revenue allocation method pertains to

Q130: What is the allocated cost to the