Answer the following question(s) using the information below:

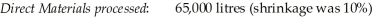

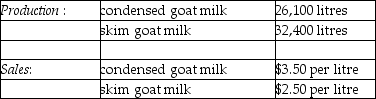

The Morton Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240. There were no inventory balances of either product.

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre. Xyla can be sold for $18 per litre.

Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50. The product can be sold for $9 per litre.

There are no beginning and ending inventory balances.

-How much (if any) extra income would Morton earn if it produced and sold all of the Xyla from the condensed goat milk? Allocate joint processing costs based upon relative sales value on the splitoff. (Extra income means income in excess of what Morton would have earned from selling condensed goat milk.)

Definitions:

Machine Hours

A measure of production time, calculated as the total hours that a machine is operated during a specific period.

Direct Labor Time

The amount of time spent by employees directly working on producing a product or service.

Overhead Cost

General, administrative, and selling expenses that are not directly tied to any specific product or service but are necessary for running the business.

Allocation Base

A measure or statistic that is used to distribute costs among different departments, projects, or products.

Q32: What is the cost transferred out assuming

Q36: Discuss some typical products which would likely

Q36: Busy Hands Craft Company is a small

Q64: What is the approximate production cost per

Q84: List and describe the procedures required in

Q106: What are the equivalent units for direct

Q111: Locked-in costs are costs that have been

Q116: Golden Company uses one raw material, gold

Q118: The incremental common cost allocation method requires

Q134: Explain the differences between short-run pricing decisions