Answer the following question(s) using the information below:

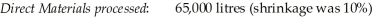

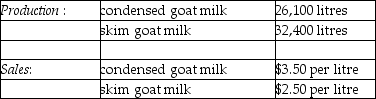

The Morton Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240. There were no inventory balances of either product.

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre. Xyla can be sold for $18 per litre.

Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50. The product can be sold for $9 per litre.

There are no beginning and ending inventory balances.

-Which method of allocating costs would be used if the selling prices of all products at the splitoff point are unavailable?

Definitions:

Social Norms

The accepted behaviors, conventions, and standards within a society or group.

Power Distance

A cultural dimension that describes the extent to which individuals in a society accept that power is distributed unequally.

High-Power-Distance Cultures

Cultures in which there is a great deal of acceptance and expectation of unequal power distribution among people, institutions, and organizations.

Rank

The position or level of importance within a hierarchy or organization.

Q25: Using the step-down method, what amount of

Q34: Measures of the balanced scorecard's internal-business-process perspective

Q67: Dutton Industries is a manufacturer of cleaning

Q75: Most companies do not measure the financial

Q77: Green Paper Company processes wood pulp into

Q101: _ is an organization's ability to offer

Q106: What is the revenue effect of price-recovery

Q109: What is the estimated net realizable value

Q129: In the banking industry, depositing a customer's

Q130: What is the allocated cost to the