Answer the following question(s) using the information below:

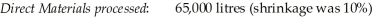

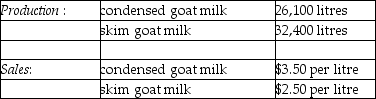

The Morton Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240. There were no inventory balances of either product.

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre. Xyla can be sold for $18 per litre.

Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50. The product can be sold for $9 per litre.

There are no beginning and ending inventory balances.

-What is the reason that accountants do not like to carry inventory at net realizable value?

Definitions:

Earnings Per Share

A company's profit divided by the number of outstanding shares of its common stock, indicating the company's profitability.

Price-Earnings Ratio

A valuation metric for a company, calculated by dividing the market price per share by the earnings per share.

Target Payout Ratio

The proportion of earnings a company plans to distribute to its shareholders as dividends, often expressed as a percentage.

Internal Rate

Short for Internal Rate of Return (IRR), it's a financial metric used to estimate the profitability of potential investments, calculated as the rate of return that sets the net present value of all cash flows from the investment equal to zero.

Q14: Deciding whether to make a component part

Q19: Which of the following journal entries properly

Q22: Calculate the allocation of packaged price for

Q25: The costs from Abnormal Spoilage should appear<br>A)

Q60: Valley West Amusement Park is evaluating its

Q75: Which of the following is NOT a

Q89: Required:<br>a. What amount is the revenue effect

Q90: A difficulty with the market share and

Q96: What is the conversion cost per equivalent

Q143: The incremental benefit or (loss) of processing