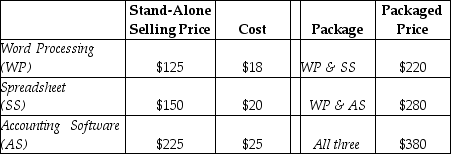

Software For You encounters revenue-allocation decisions with its bundled product sales. Here, two or more units of the software are sold as a single package. Managers at Software For You are keenly interested in individual product-profitability figures. Information pertaining to its three bundled products and the stand-alone selling prices of its individual products is as follows:

Required:

Required:

a. Using the stand-alone revenue-allocation method, allocate the $380 packaged price of "All Three" to the three software products

b. Allocate the $380 packaged price of "All Three" to the three software products using the incremental revenue-allocation method. Assume Word Processing is the primary product, followed by Spreadsheet, and then Accounting Software.

b. Allocate the $380 packaged price of "All Three" to the three software products using the incremental revenue-allocation method. Assume Word Processing is the primary product, followed by Spreadsheet, and then Accounting Software.

Definitions:

Materials Price Variance

The difference between the actual cost of materials used in production and the standard cost of those materials.

Direct Materials

Raw materials that are directly traceable to the finished product and constitute a significant part of its costs.

Variable Overhead Spending Variance

The difference between actual variable overhead costs incurred and the expected (standard) costs based on the actual level of production activity.

Fixed Overhead Spending Variance

The difference between the actual and budgeted fixed overhead costs incurred during a period.

Q14: Manufacturing lead times can affect costs but

Q17: Equivalent units measure output in terms of

Q33: What are the objectives in accounting for

Q51: What is the total amount debited to

Q65: The Parson Valve Corporation was recently formed

Q74: Management has offered to allow the prevention

Q103: Using the direct method, what amount of

Q105: _ refers to the average amount of

Q123: A company sells three different types of

Q137: If a single-rate cost-allocation method is used,