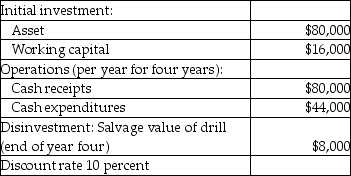

Use the information below to answer the following question(s) .Wet Water Company drills residential and commercial wells.The company is in the process of analyzing the purchase of a new drill.Information on the proposal is provided below:

Note: Other than the initial investment, cash flows are end of period.The working capital is returned at the end of the investment period.

Note: Other than the initial investment, cash flows are end of period.The working capital is returned at the end of the investment period.

-Alberta Ltd.is considering the purchase of new machinery which costs $147,800.The machine is expected to save $42,300 in operating costs annually for the next 7 years.By how much can the annual cost savings fall (to the nearest hundred dollars) and still provide a 16% return? Ignore income taxes.

Definitions:

Periodic Inventory System

An inventory system that updates the inventory balance at specific intervals, requiring a physical count of inventory to calculate cost of goods sold.

Gross Method

An accounting method for recording purchases at the full invoice price without deducting any cash discounts.

Credit Terms

Conditions under which credit is extended by a lender to a borrower, including repayment schedule, interest rate, and due dates.

Gross Profit

The financial gain obtained by subtracting the cost of goods sold from the revenue generated from sales, excluding operating expenses.

Q4: For supply item ABC, Andrews Company has

Q10: The first step in the capital budgeting

Q30: In determining whether to keep a machine

Q35: A Canadian company has subsidiaries in France,

Q51: Coptermagic Company supplies helicopters to corporate clients.

Q55: Neptune Ltd. wants to expand its operations

Q71: Which of the following statements is False?<br>A)

Q71: The Alpha Beta Corporation experiences numerous instances

Q81: What costs would be associated with normal

Q113: Warranty repair costs are<br>A) prevention costs.<br>B) appraisal