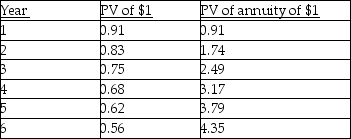

For Years 1 through 6 Better Products Ltd. had annual net income of $20,000, CCA of $40,000 each year, a 40 percent tax rate, a discount rate of 10 percent and annual cash sales of $200,000. The depreciable assets of Better Products belong in several different classes under the Income tax Act, have a salvage value of zero at the end of six years, and were all bought new at the beginning of Year 1. The present value factors, in simplified form, for 10 percent are:

-What is the annual expense deduction for CCA?

Definitions:

Arterial Blood Gases

A test measuring oxygen and carbon dioxide levels in arterial blood to assess lung function and the body's acid-base balance.

Deficient Fluid Volume

A medical condition characterized by a lower than normal amount of fluid in the body, often resulting from dehydration, loss of blood, or other factors.

Electrolyte Imbalance

A condition in which the levels of electrolytes in the body are either too high or too low, affecting various bodily functions.

Potassium

An essential dietary mineral and electrolyte that plays significant roles in heart function, nerve signal transmission, and muscle contraction.

Q31: If the Assembly Division sells 100,000 pairs

Q51: A company's General Ledger recorded sales of

Q96: Companies implementing Just-in-time production systems manage inventories

Q103: The demand for Ballard's Glass Company's products

Q107: USCo, a domestic corporation, receives $100,000 of

Q109: Two common operational measures of time are

Q121: Which of the following is true concerning

Q128: OutCo, a controlled foreign corporation owned 100%

Q138: Briefly explain each of the four levers

Q145: Acme Janitor Service has always taken pride