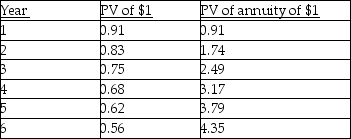

For Years 1 through 6 Better Products Ltd. had annual net income of $20,000, CCA of $40,000 each year, a 40 percent tax rate, a discount rate of 10 percent and annual cash sales of $200,000. The depreciable assets of Better Products belong in several different classes under the Income tax Act, have a salvage value of zero at the end of six years, and were all bought new at the beginning of Year 1. The present value factors, in simplified form, for 10 percent are:

-Biermann Equipment is a publicly held corporation required to pay income taxes. For the current year it had revenues of $5,000,000 and cash expenses of $3,000,000, and claimed CCA of $200,000. The company has a 30 percent tax rate. What would be the net cash flow for the current year if all revenues were received in cash?

Definitions:

Progressive Matrices

A type of IQ test that measures abstract reasoning, typically using patterns of shapes with a piece missing, where the participant must identify the correct piece to complete the pattern.

Stanford-Binet

An individually administered intelligence test that was first developed to assess cognitive abilities in children but is now used for all ages.

Immigrated

The act of moving into a new country or region to live, usually for the purpose of permanent residence.

Intelligence Quotient

Intelligence Quotient, commonly known as IQ, is a measure of a person's intellectual abilities in relation to their age group.

Q37: The differential approach calculates the present value

Q40: What would be the monthly operating advantage

Q51: A company's General Ledger recorded sales of

Q55: Carrying costs arise when a customer demands

Q56: What is the transfer price per litre

Q88: Relevant cash flows are expected future cash

Q103: Complete Microfilm Products manufactures microfilm cameras. For

Q105: _ refers to the average amount of

Q113: A company's weighted-average cost of capital [WACC]

Q135: How should environmental and ethical issues affect