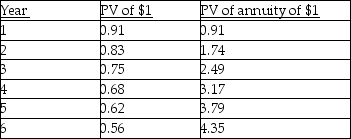

For Years 1 through 6 Better Products Ltd. had annual net income of $20,000, CCA of $40,000 each year, a 40 percent tax rate, a discount rate of 10 percent and annual cash sales of $200,000. The depreciable assets of Better Products belong in several different classes under the Income tax Act, have a salvage value of zero at the end of six years, and were all bought new at the beginning of Year 1. The present value factors, in simplified form, for 10 percent are:

-What is the tax saving from CCA in each year?

Definitions:

Comparable Worth

The concept that jobs of equal value to an organization should receive the same level of compensation, regardless of the job holder's gender or other demographics.

Employee Surveillance

The monitoring of employee activities and behaviours in the workplace using various methods and technologies.

Information Technology

The use of computers and software to manage information, including storing, retrieving, transmitting, and manipulating data.

External Recruitment

The process of searching for and hiring candidates from outside the organization to fill open positions.

Q33: The costs relating to product testing are

Q57: Which of the following is NOT a

Q67: A tax haven often is:<br>A) A country

Q91: Based on the above data only, what

Q94: When cash flows are stated in real

Q99: It is an error when accounting for

Q105: When making capital-budgeting decisions, the inflation rate<br>A)

Q114: What is the net change in the

Q115: Shrinkage costs result from water damage to

Q159: Which of the following statements regarding foreign