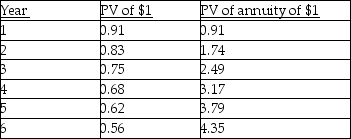

For Years 1 through 6 Better Products Ltd. had annual net income of $20,000, CCA of $40,000 each year, a 40 percent tax rate, a discount rate of 10 percent and annual cash sales of $200,000. The depreciable assets of Better Products belong in several different classes under the Income tax Act, have a salvage value of zero at the end of six years, and were all bought new at the beginning of Year 1. The present value factors, in simplified form, for 10 percent are:

-Biermann Equipment is a publicly held corporation required to pay income taxes. For the current year it had revenues of $5,000,000 and cash expenses of $3,000,000, and claimed CCA of $200,000. The company has a 30 percent tax rate. What would be the net cash flow for the current year if all revenues were received in cash?

Definitions:

Q6: Walton Industries has two divisions: Machining and

Q15: The total project approach to capital budgeting<br>A)

Q38: If annual carrying costs are excluded when

Q69: Owen-King Company sells optical equipment. Lens Company

Q73: A U.S. taxpayer may take a current

Q84: Which of the following methods is not

Q102: What is the change in the daily

Q119: An example of rework is when a

Q121: A company has two divisions. The Bottle

Q126: Which of the following statements regarding translation