Use the information below to answer the following question(s) .

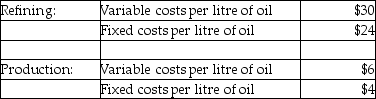

Blackoil Corp. has two divisions, Refining and Production. The company's primary product is Clean Oil. Each division's costs are provided below:

The Production Division is able to sell the oil to other areas for $24 per litre. The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers. The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

The Production Division is able to sell the oil to other areas for $24 per litre. The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers. The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

-Division A sells soybean paste internally to Division B, which, in turn, produces soybean burgers that sell for $5 per kilogram. Division A incurs costs of $0.75 per kilogram, while Division B incurs additional costs of $2.50 per kilogram. Which of the following formulas correctly reflects the company's operating income per kilogram?

Definitions:

Variable Costs

Expenses that change in proportion to the level of production or business activity.

Fixed Costs

Fixed costs are business expenses that remain constant regardless of the level of production or sales activities, such as rent, salaries, and insurance.

Contribution Margin

The sales price minus the variable costs of a product, indicating how much selling one more unit adds to profit.

Variable Costs

Costs that vary directly with the level of production or volume of output, such as raw materials and direct labor.

Q9: Collins, Inc. received gross foreign-source dividend income

Q11: For project Gemini of Space Company the

Q33: Berryton Products' only product has an annual

Q53: If the nominal rate of interest is

Q56: What is the transfer price per litre

Q70: Allan Ltd. is considering purchasing a new

Q79: Which of the following plans should be

Q85: Consolidated group members each are jointly and

Q106: It is possible to increase the overall

Q124: Companies can achieve significant gains by sharing