Answer the following question(s) using the information below.

Beta Shoe Ltd.manufactures only one type of shoe and has two divisions,the Sole Division,and the Assembly Division.The Sole Division manufactures soles for the Assembly Division,which completes the shoe and sells it to retailers.The Sole Division "sells" soles to the Assembly Division.The market price for the Assembly Division to purchase a pair of soles is $20.(Ignore changes in inventory. ) The fixed costs for the Sole Division are assumed to be the same over the range of 40,000-100,000 units.The fixed costs for the Assembly Division are assumed to be $7 per pair at 100,000 units.

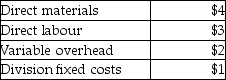

Sole's costs per pair of soles are:

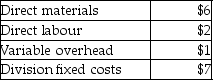

Assembly's costs per completed pair of shoes are:

Assembly's costs per completed pair of shoes are:

-Assume the transfer price for a pair of soles is 180% of total costs of the Sole Division and 40,000 of soles are produced and transferred to the Assembly Division.The Sole Division's operating income is

Definitions:

Security Market Line (SML)

Positively sloped straight line displaying the relationship between expected return and beta.

Arbitrage Pricing Theory (APT)

An equilibrium asset pricing theory that is derived from a factor model by using diversification and arbitrage. It shows that the expected return on any risky asset is a linear combination of various factors.

Arbitrage Pricing Theory (APT)

A financial model that estimates the price of assets based on the relationship between their expected return and macroeconomic factors that influence all assets' returns.

Market Risk Premium

The surplus return an investor aspires to earn by holding onto a market portfolio fraught with risks as compared to safeguarded, risk-free assets.

Q15: Full-cost transfer prices will maximize overall corporate

Q51: Problems encountered when the payback method is

Q59: How many deliveries will be made during

Q72: Which of the following statements regarding the

Q81: Post-investment audits<br>A) should be done as soon

Q84: Wilson's Deli can predict with virtual certainty

Q97: Which of the following statements regarding a

Q101: Which of the following statements about non-profit

Q127: An affiliated group exists where there is

Q145: Acme Janitor Service has always taken pride