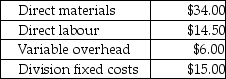

Answer the following question(s) using the information below.Cool Air Ltd.manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division.The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells them to retailers.The Compressor Division "sells" compressors to the Assembly Division.The market price for the Assembly Division to purchase a compressor is $77.(Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units.The fixed costs for the Assembly Division are assumed to be $15.00 per unit at 10,000 units.Compressor's costs per compressor are:

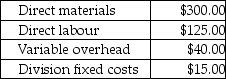

Assembly's costs per completed air conditioner are:

Assembly's costs per completed air conditioner are:

-What is the transfer price per compressor from the Compressor Division to the Assembly Division if the method used to place a value on each compressor is 150% of variable costs?

Definitions:

Leader Substitutes Theory

A theory suggesting that certain characteristics of the situation or the followers can diminish or replace the need for leadership.

Hierarchical Leadership

A leadership structure where decision-making and authority flow from the top down, within clearly defined ranks and positions.

Capable Substitutes

Effective alternatives or replacements that possess the necessary skills or attributes to fulfill a specific role or task.

Managers

are individuals responsible for planning, directing, and overseeing the operations and employees within an organization, ensuring that goals and objectives are achieved efficiently.

Q15: Which of the following is not a

Q17: The consequences of capital expenditures are<br>A) quantitative

Q57: Which of the following is NOT a

Q59: Many common performance measures rely on internal

Q64: Describe the purpose, features and benefits of

Q69: Johnson's Mini Mart is considering the purchase

Q76: The excess present value index is<br>A) the

Q80: Abbott, Inc., a domestic corporation, reports worldwide

Q82: If the internal rate of return is

Q109: In computing consolidated taxable income, the purchase